UK house prices rose just 0.1% month on month in October while the annual growth rate slowed to 2.4%, from 3.2% in September, the Nationwide House Price Index revealed last week.

The price of a typical UK home increased by 2.4% year on year in October, though this represented a modest slowdown from the 3.2% pace recorded the previous month. House prices rose by 0.1% month on month in October, after taking account of seasonal effects.

Robert Gardner, Nationwide’s Chief Economist, says: “Housing market activity has remained relatively resilient in recent months, with the number of mortgage approvals approaching the levels seen pre-pandemic, despite the significantly higher interest rate environment.

“Solid labour market conditions, with low levels of unemployment and strong income gains, even after taking account of inflation, have helped underpin a steady rise in activity and house prices since the start of the year.”

ACTIVITY TO STRENGTHEN

He adds: “Providing the economy continues to recover steadily, as we expect, housing market activity is likely to continue to strengthen gradually as affordability constraints ease through a combination of modestly lower interest rates and earnings outpacing house price growth.”

STAMP DUTY

How much of an impact will the expiry of the stamp duty holiday have on activity levels?

Gardner adds: “The Chancellor confirmed that the temporary increase in the nil rate stamp duty thresholds (in England & Northern Ireland) would expire on 31 March 2025 and revert back to their previous levels, as had originally been set out by the previous government.

“From that point, for first time buyers purchasing a property of under £500,000, the nil rate band threshold will fall to £300,000 from £425,000 at present, while for other residential buyers, the nil rate band threshold will decline to £125,000, from £250,000.

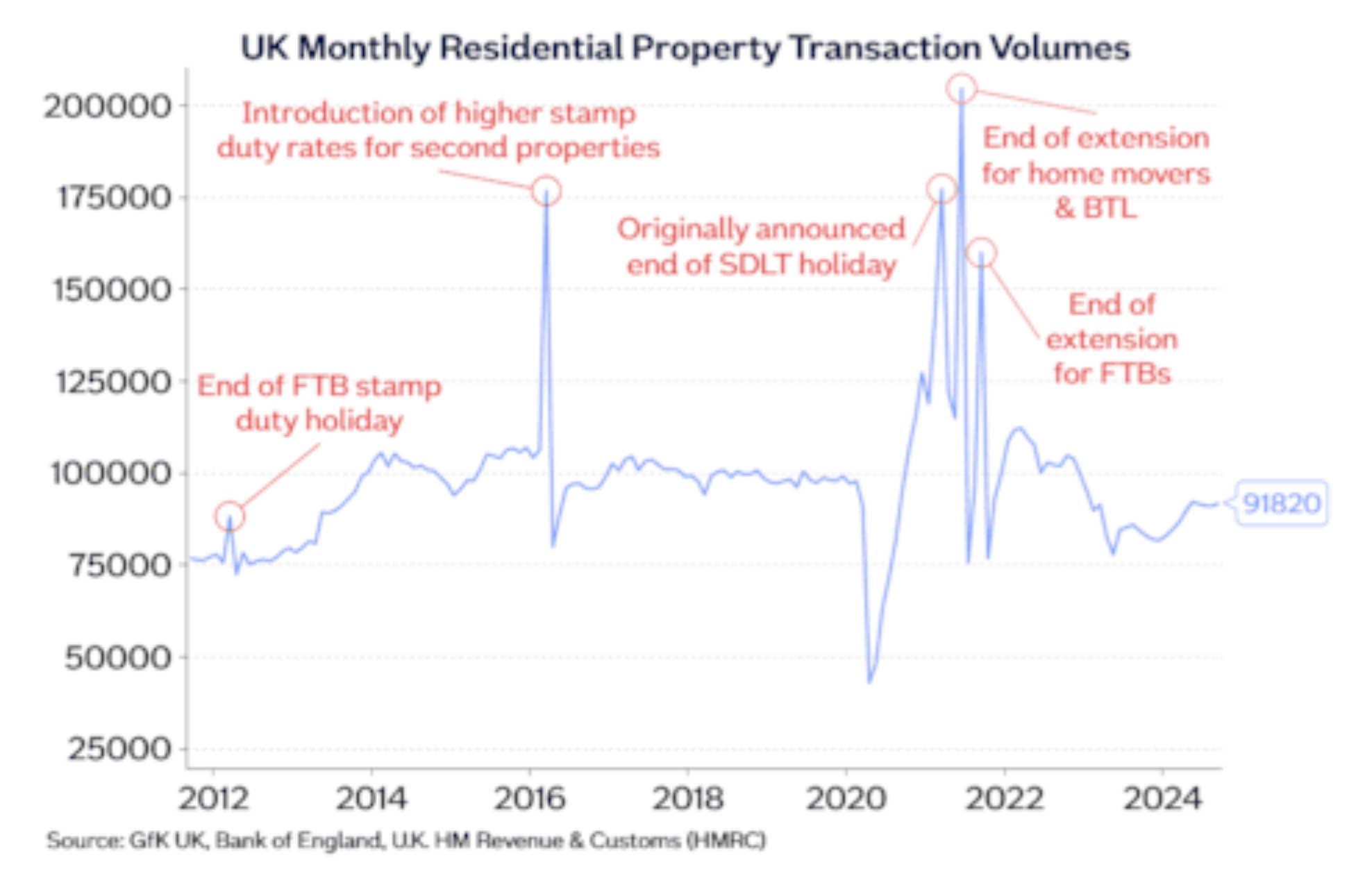

“The main impact of the stamp duty changes is likely to be on the timing of property transactions, as purchasers aim to ensure their house purchases complete before the tax change takes effect.

“This will lead to a jump in transactions in the first three months of 2025 (especially March), and a corresponding period of weakness in the following three to six months, as occurred in the wake of previous stamp duty changes.”

TRANSACTION VOLUMES

But he adds: “However, the swings in activity are likely to be somewhat less pronounced, in this instance, given that the stamp duty reduction has been in place for some time and its planned expiry was well known.

But he adds: “However, the swings in activity are likely to be somewhat less pronounced, in this instance, given that the stamp duty reduction has been in place for some time and its planned expiry was well known.

“Affordability is also still relatively stretched at present as a result of the higher interest rate environment, which is acting to dampen housing market activity more generally. Nevertheless, determining the underlying strength of the market will become more challenging until this period of volatility passes.”

FIRST-TIME BUYERS

Data for the year to June 2024 suggests that the stamp duty change will affect around one in five first-time buyers, though the impact will vary significantly across the country, largely as a result of the difference in house prices across the UK.

Gardner says: “The largest effects are likely to be in the South East of England, where 40% of first-time buyers paid between £300,000 and £425,000 for their homes, where the change will increase cost of moving for the affected first-time buyers by £2,900 on average. The areas least affected are Yorkshire & The Humber, the North of England and Northern Ireland, where less than 10% of first-time buyers paid between £325k and £425k for their homes.

“The Chancellor also announced an increase in the higher rate of stamp duty for additional dwellings by 2 percentage points to 5%, which took effect on 31 October.

“Based on data for the year to June 2024, this would affect around 194,000 transactions, around one in five residential transactions in England & Northern Ireland. We estimate for a typical buy to let purchase, this would add approximately £4,000 to stamp duty costs. Consequently, this may dampen demand in this part of the housing market.”

BUYER CONFIDENCE

Myles Moloney, Area Sales Manager at Chase Buchanan, says: “At the beginning of October we saw continued buyer confidence which was boosted by favourable mortgage rates and a greater number of properties being put up for sale.

“As we were nearing the Autumn Budget, however, house hunters and sellers grew more cautious.”

Tom Bill, head of UK residential research at Knight Frank, adds: “We expect this year’s house price recovery to come under pressure following the increase in borrowing costs triggered by the Budget.

“How much depends on the reaction of bond markets in coming days and the Bank of England’s rate decision and comments next week.

“It appears a ‘mini-Budget’ moment has so far been avoided.”

STOCK INCREASE

Jeremy Leaf, north London estate agent and a former RICS residential chairman, says: ’The number of sales agreed has increased steadily since base rate was reduced in the summer, as have mortgage approvals.

“However, the increase in stock, particularly from landlords who have had their fill of tax and regulatory issues, will worsen.

“We expect the Budget will increase demand for smaller properties as first-time buyers seek to profit from investors unwilling to pay higher taxes before stamp duty rates rise early next year.”

Marc von Grundherr, Director of Benham and Reeves, says: “A slower rate of house price growth was always to be expected during a Budget month as the housing market pauses for breath to see what the government has up its sleeve, but despite this, the market still recorded positive growth on both a monthly and annual basis which demonstrates just how far we’ve come so far this year.

“Whilst there were no positive Budget initiatives announced that will supercharge market activity, we do expect to see a heightened level of activity between now and March of next year, as homebuyers scramble to complete before stamp duty relief reverts back to previous thresholds.”

STABILITY

Ed Phillips, Lomond Chief Executive, says: “Stability has been the key component to the returning health of the UK housing market and so it’s no surprise that the rate of house price growth slowed during October, with the property sector enveloped by Autumn Statement uncertainty.

“Now that the dust has settled and the property market has escaped largely unscathed, we expect the rate of growth seen across the market to once again accelerate, particularly with further cuts to interest rates on the cards.”

HOLDING FIRM

Verona Frankish, Chief Executive of Yopa, says: “House prices have held firm during Budget month which is an impressive performance in itself despite the rate of growth seen falling month on month.

“The impending stamp duty relief deadline in March of next year will certainly light a fire under those buyers currently progressing through the transaction process, or considering a purchase this side of Christmas.

“However, whilst many will be keen to transact before stamp duty thresholds increase, it certainly won’t cause a cliff edge for the housing market come next year. Stamp duty has long been a thorn in the side of homebuyers but not one that is significant enough to deter them from their aspirations of homeownership.

“In fact, the prospect of further interest rate cuts and the increase in long-term mortgage affordability that these will bring are far more likely to influence buyer ambitions and help keep the housing market moving forward.”

And Tomer Aboody, director of specialist lender MT Finance, adds: “Another slight increase in monthly house prices is further demonstrating the confidence which has been felt with a lower rate environment, on the back of some good inflation numbers.

“With mortgage rates at more affordable levels, borrowers will be further incentivised to take the plunge, especially in the wake of Rachel Reeves’ Budget, which could possibly lead to higher rates.”